Interest rates play a huge role in shaping the economy, and the Bank of Canada (BoC) has the power to adjust them based on financial conditions. Whether you’re buying a home, running a business, or simply trying to grow your savings, understanding how these rates work can help you make better financial decisions. In this guide, we’ll break down what the Bank of Canada’s interest rates are, why they matter, and how they impact you in 2025 and beyond.

Table of Contents

ToggleWhat Are Bank of Canada Interest Rates?

The Bank of Canada’s interest rate, also called the overnight rate, is the rate at which big banks borrow and lend money to each other for very short periods, usually overnight. While this may seem like something only bankers need to worry about, it actually affects everything from mortgage rates to credit card interest.

The BoC sets this rate eight times a year, adjusting it to keep inflation in check and ensure economic stability. Ideally, they aim for a 2% inflation rate, which is considered a healthy balance.

If inflation rises too much, the BoC may increase interest rates to slow down borrowing and spending. Conversely, if inflation drops too low, they might cut rates to encourage people to spend and invest more. These adjustments help keep Canada’s economy running smoothly.

Why Do Bank of Canada Interest Rates Matter?

Interest rates influence almost every aspect of financial life. Here’s how they affect different groups:

1. Consumers

-

Mortgages: If interest rates drop, variable-rate mortgages become cheaper, making homeownership more affordable. If rates rise, mortgage payments go up.

-

Savings: Lower interest rates mean savings accounts and bonds earn less interest, making it harder to grow your money.

-

Loans: Personal loans, car loans, and credit card interest rates often move in response to BoC decisions.

2. Businesses

-

Lower interest rates: Cheaper loans help businesses invest in growth, hire employees, and expand operations.

-

Higher interest rates: Borrowing becomes more expensive, which can slow down business investments.

3. The Economy

-

Consumer spending and business investment: Interest rates can either boost or cool down economic growth.

-

The Canadian dollar: Higher rates make the Canadian dollar stronger, which makes imports cheaper but can hurt exports.

Recent Changes to Bank of Canada Interest Rates

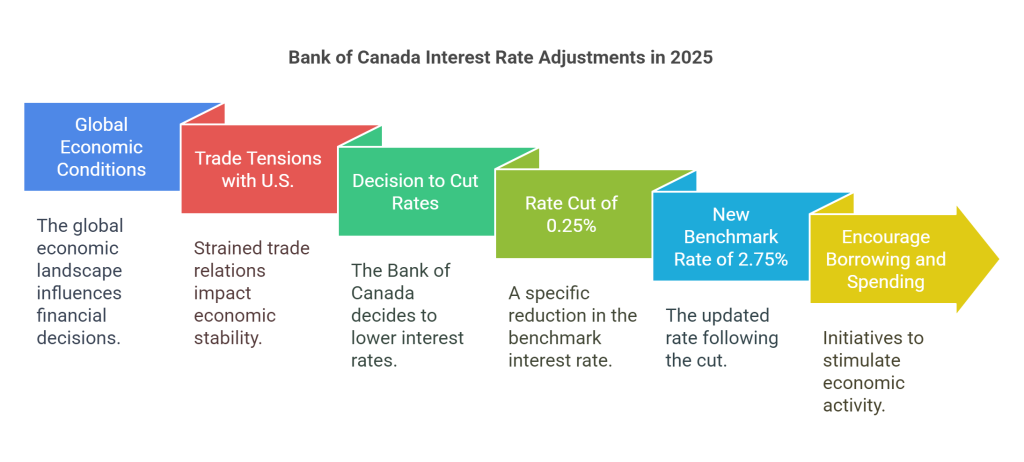

In 2025, the Bank of Canada has made several adjustments to its rates in response to global economic conditions. For example, in March 2025, the BoC cut its benchmark interest rate by 0.25% to 2.75%. This was the seventh consecutive rate cut, driven by trade tensions between Canada and the U.S., which created uncertainty for Canadian businesses. According to the BoC, these rate cuts are meant to encourage borrowing and spending, helping to offset the negative economic effects of these trade issues.

How Bank of Canada Interest Rates Affect You in 2025

Interest rates influence almost every aspect of financial life. Here’s how they affect different groups:

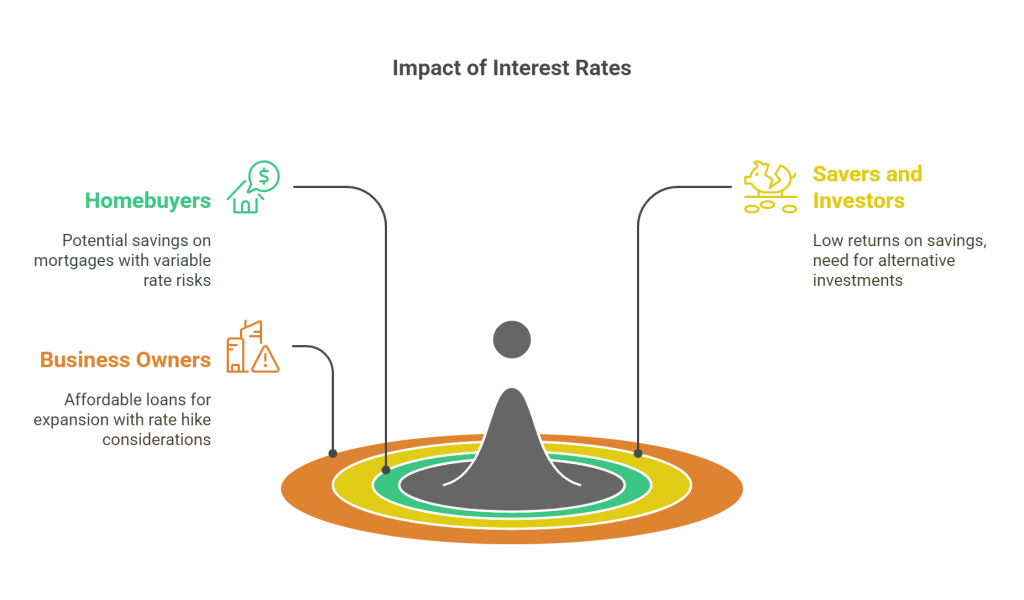

1. Homebuyers and Homeowners

-

If you’re thinking about buying a home or refinancing, the current low interest rates could save you a lot of money. For example, a 0.25% rate cut on a $500,000 mortgage could lower your monthly payment by about $60. However, rates can change. If you choose a variable-rate mortgage, be prepared for future rate increases.

2. Savers and Investors

-

With rates at historic lows, savings accounts and GICs (Guaranteed Investment Certificates) aren’t offering great returns. If you want higher gains, you might need to consider stocks, mutual funds, or real estate.

3. Business Owners

-

If you own a business, now could be a great time to invest in new equipment or expansion, since loans are more affordable. However, you should still plan for the possibility of future rate hikes.

Predictions for Bank of Canada Interest Rates in 2025 and Beyond

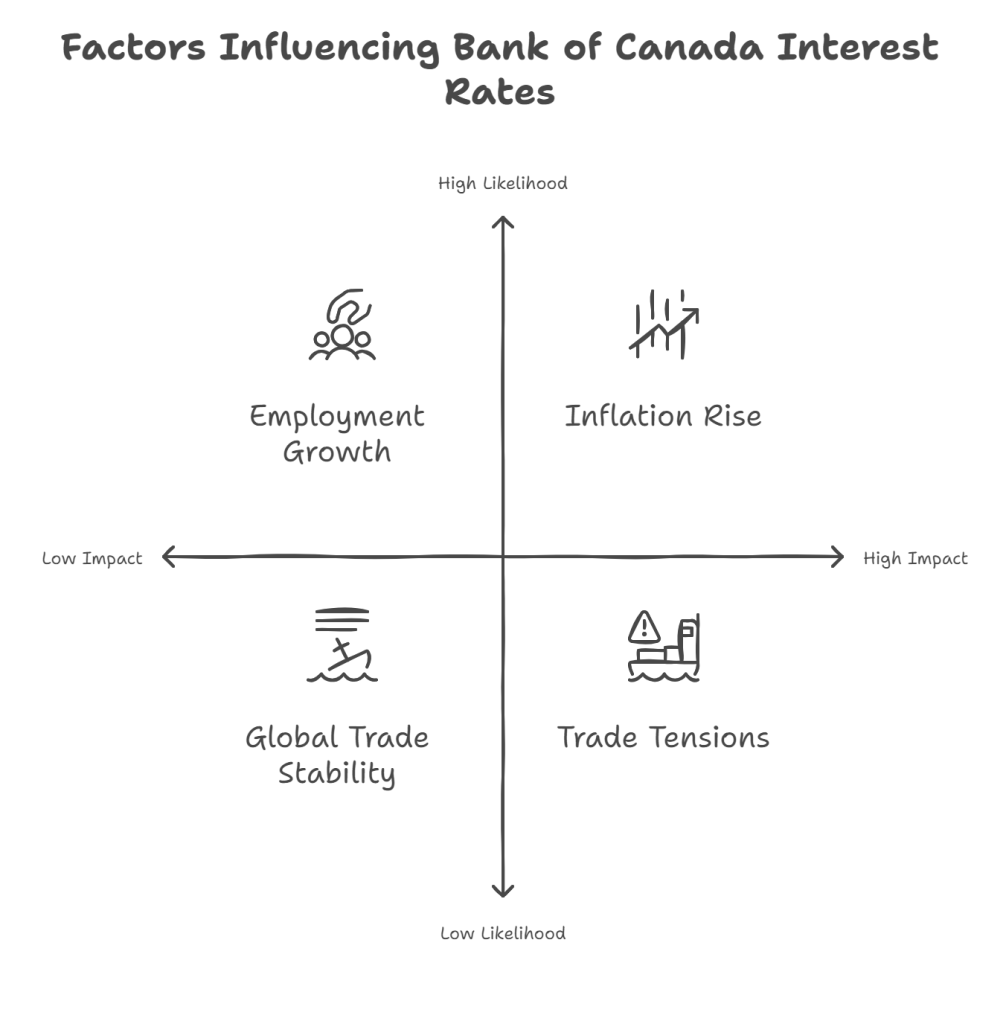

Experts predict that the Bank of Canada will maintain a cautious approach to interest rates throughout 2025. According to a Bloomberg survey, the benchmark rate is expected to stay between 2.50% and 2.75% for the rest of the year. However, this could change depending on:

-

Inflation: If inflation rises above 2%, the BoC may increase rates.

-

Global trade: Continued trade tensions could lead to more rate cuts.

-

Employment trends: If job growth is strong, the BoC might raise rates to prevent the economy from overheating.

How to Stay Updated on Bank of Canada Interest Rates

The BoC announces interest rate decisions eight times a year. Here are the key dates for 2025:

-

April 16, 2025

-

June 4, 2025

-

July 23, 2025

-

September 10, 2025

-

October 29, 2025

-

December 10, 2025

To stay informed, check the Bank of Canada’s official website or follow major financial news sources.

Frequently Asked Questions (FAQs)

As of March 2025, the BoC’s benchmark interest rate is 2.75%.

Variable-rate mortgages change directly with BoC interest rate decisions. Fixed-rate mortgages are influenced by broader economic trends and bond markets.

While they are expected to stay stable, they could increase if inflation rises or the economy grows faster than expected.

Consider locking in a fixed-rate mortgage. Pay down debt to reduce interest costs in case of future rate hikes.

Final Thoughts

The Bank of Canada’s interest rates play a major role in shaping financial decisions. Whether you’re buying a home, running a business, or saving for the future, staying informed can help you make smarter money choices. By keeping an eye on BoC rate changes and planning ahead, you can navigate the economy with confidence. For the latest updates, check the Bank of Canada’s website or speak with a financial expert.

Sources

If you found this guide helpful, feel free to share it with others who might benefit!

Author

-

Hyacinth Mezie is a brand strategist, content creator, and digital marketing expert with a passion for empowering financial solutions through storytelling. At Quick Collect, Hyacinth combines research-driven insights with creative content development to connect audiences with seamless cross-border money transfer services. Beyond crafting impactful narratives, Hyacinth enjoys exploring new ideas, learning from diverse experiences, and building meaningful connections. Got a message or ideas? Hyacinth is always ready to engage thoughtfully.

View all posts