In today’s interconnected world, navigating the currency exchange landscape can be daunting, especially when considering the conversion from Nigerian Naira to Canadian Dollars. This process presents various challenges, from fluctuating rates to security concerns. However, finding a safe and reliable method for this exchange is crucial for individuals and businesses alike.

Challenges of Exchanging Nigerian Naira to Canadian Dollars

-

Limited Availability in Local Banks

In today’s interconnected world, navigating the currency exchange landscape can be daunting, especially when considering the conversion from Nigerian Naira to Canadian Dollars. This process presents various challenges, from fluctuating rates to security concerns. However, finding a safe and reliable method for this exchange is crucial for individuals and businesses alike.

-

Fluctuating Exchange Rates

The volatility of exchange rates poses a significant challenge, leading to uncertainties about the value received in the exchange process.

-

Security Concerns

Safety is paramount when dealing with currency exchange. Individuals often worry about the risk of scams or fraudulent activities.

Options for Safe Currency Exchange

-

Reliable Physical Exchange Centers

Some physical exchange centers provide reliable services, ensuring security and offering competitive rates for currency exchange.

-

Online Currency Exchange Platforms

Online platforms offer convenience but often lack the assurance of security and transparency.

-

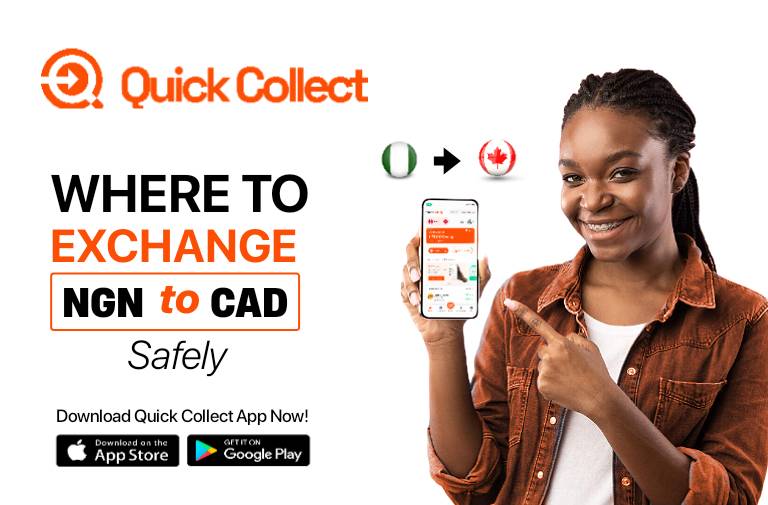

Quick Collect: A Trusted Solution

Among the various options available, Quick Collect stands out as the most reliable app for sending money from Canada to Nigeria and Ghana securely. This app ensures quick transfers without any additional or hidden fees, providing an instant and secure solution.

DOWNLOAD QUICK COLLECT APP NOW

Advantages of Quick Collect App

-

Instant Transfer

Quick Collect facilitates immediate transfers, ensuring that recipients in Nigeria and Ghana receive funds promptly.

-

Transparency in Fees

The app maintains transparency in its fee structure, eliminating any hidden charges that commonly arise during currency exchanges.

-

Reliability and Security

With Quick Collect, users can trust the reliability and security of their transactions, safeguarding their funds throughout the exchange process.

How to Exchange Currency Safely using Quick Collect

For users seeking a secure exchange, Quick Collect offers a straightforward process. Simply download the app, follow the intuitive interface, and execute your transactions seamlessly.

Comparative Analysis of Exchange Platforms

A comparative analysis showcases Quick Collect’s superiority over other services, emphasizing its speed, reliability, and transparency.

Tips for Safe and Efficient Currency Exchange

Understanding exchange rates and adopting secure transaction practices are key to ensuring a smooth and safe currency exchange experience.

In conclusion, navigating the landscape of exchanging Nigerian Naira to Canadian Dollars requires a reliable, secure, and efficient method. Quick Collect stands out as a beacon of trustworthiness, providing users with instant transfers, transparency in fees, and the assurance of security throughout transactions.

FAQ

- Is Quick Collect available for other currency exchanges? Quick Collect specializes in facilitating money transfers from Canada to Nigeria and Ghana. While its primary focus is on these two currencies, the app will expand its services to include other currencies in the future.

- How secure is the Quick Collect app for transferring money? Security is a top priority for Quick Collect. The app employs robust encryption and security protocols to safeguard users’ transactions and personal information. It ensures a secure environment for money transfers.

- Are there any limits on the amount of money one can transfer using Quick Collect? The daily limit is 5,000 CAD, weekly limit is 15,000 CAD while the monthly limit 30,000 CAD. The CAD wallet deposit is however unlimited.

- Does Quick Collect charge any fees for currency exchange? Quick Collect prides itself on transparency regarding fees. Zero fee on any transfer made with the app

- Can businesses use Quick Collect for international transactions? Absolutely! Quick Collect caters to both individual and business users. Businesses seeking to conduct international transactions between Canada, Nigeria, and Ghana can benefit from Quick Collect’s reliable and efficient service. The app offers a seamless platform for businesses to transfer funds securely and quickly.

wonderful put up, very informative. I wonder why the other experts of this

sector doo not realize this. You must proceed your writing.

I’m confident, you’ve a great readers’ basse already!

This really answered my problem, thank you!

I was just looking for this information for a while. After 6 hours of continuous Googleing, finally I got it in your web site. I wonder what is the lack of Google strategy that don’t rank this kind of informative sites in top of the list. Generally the top web sites are full of garbage.

Right now it seems like Drupal is the best blogging platform out there right now. (from what I’ve read) Is that what you are using on your blog?

Thank you for the auspicious writeup. It in fact was a

amusement account it. Look advanced to more added agreeable from you!

However, how could we communicate?

Here is my web blog … site

This information is invaluable. How can I find out more?

My web page – site

This page truly has all of the info I wanted concerning this subject and didn’t know who to ask.

My website: site

I am truly thankful to the holder of this website who has shared this fantastic article at at this time.

my website site

Aw, this was an exceptionally nice post. Finding the time and actual

effort to create a top notch article… but what can I say…

I hesitate a lot and never manage to get anything done.

My web site: site

Hello there! This is kind of off topic but I need some advice from

an established blog. Is it hard to set up your own blog?

I’m not very techincal but I can figure things out pretty

quick. I’m thinking about setting up my own but I’m not

sure where to start. Do you have any ideas or suggestions?

Many thanks

My homepage – site

Everyone loves it whenever people get together and share views.

Great blog, keep it up!

Check out my webpage site

Good info. Lucky me I discovered your blog by accident (stumbleupon).

I have saved it for later!

Here is my blog; site

Hello! I’ve been following your blog for a while now

and finally got the courage to go ahead and give you

a shout out from Austin Tx! Just wanted to tell you keep up the great job!

My web page site

This is very interesting, You’re a very skilled blogger. I’ve joined your feed and

look forward to seeking more of your excellent post.

Also, I’ve shared your site in my social networks!